But another thing folks from everywhere fly to Asia for are Filipinos. They’re warm, easy-going, family-oriented, and just happy and positive people. And every year, people are getting the drift of why so many are so intrigued with the Philippines.

Let’s talk GDP

As of late 2022, the Philippines has a total GDP of $401.662 billion and is expecting a 6% growth in 2023. This southeast asian nation is also home to almost 114 million Filipinos, with 10% of its population spread all over the world, making them one of the most wide-spread nationalities in the world. Some of them are dual citizens living in other countries, some are digital nomads, while a huge chunk are OFWs or “Overseas Filipino Workers.” Filipinos are everywhere that I can bet you, no matter which country you’re in while you read this, you are bound to meet a Filipino!

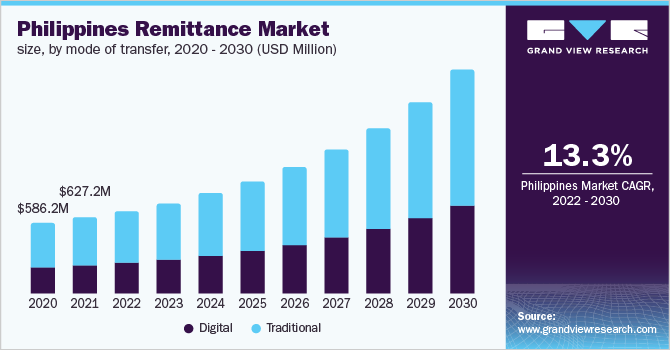

Given this diaspora, remittance is unsurprisingly a cornerstone in the Philippines’ economy – carrying 9.31% of its total GDP landing them on the 28th spot for the countries with the most remittance received.

How much is remmittance actually worth?

As of mid 2022, there are 2.24 million OFWs and 1.5 million Filipino digital entrepreneurs contributing to remittance. You’ll be surprised to know that the Philippines is one of the fastest-growing markets in the world and a big portion is thanks to its digital entrepreneurs and freelancers. From virtual assistants to graphic designers, Filipinos are top-of-mind when it comes to hiring overseas professionals – no wonder startups like Support Shepherd, Composite Global partners, Growth Assistant, and Hopla are on a roll these days!

And if you’ve met a Filipino you know how family-oriented they can be, which means those internationally-working professionals are still somehow shouldering expenses back home. So not only are these professionals helping boost the economy through remittance but they’re also doing that through taxes.

Whether you’re working from the Philippines or outside of it – if you are a digital entrepreneur your taxes fall under the PROF category which requires you to pay a 5 to 32% tax depending on BIR’s recommendation.. And when your annual income exceeds ₱1,919,500 – you’ll then be required to apply for VAT (value added tax) which is a 12% tax on top of what you make.

These are notable information, given that the Philippines collects more than $11B in remittance annually!

Who you should look out for

If crossborder payments is such a big market in the Philippines, how do these Filipino digital entrepreneurs collect money from across the globe? Fortunately, the Philippines has a lot of local options to claim their salary or remittance from abroad. Typically, you just have to find a remittance center or in the Philippines is called “pera padala,” fill up the form, line up, submit 1 primary government-issued IDs (could be your passport, a driver’s license, PRC ID, or your NBI clearance) then claim your remittance.

However, reading from that last paragraph, you can tell that a lot of these options are still quite traditional, comes with a cap, and on top of the time it takes to collect remittance, fees also vary depending on who you’re collecting from and how much you collect.

A few household names are:

LBC instant peso padala: LBC allows you to send/receive money up to P5,000 (that’s about $100 depending on FX) with a charge that goes up to ₱125 – that’s a 2.5% service charge.

Palawan Express Pera Padala: Palawan express allows you to send up to ₱50,000 (that’s about $1,000) for ₱2 to ₱345, depending on how much you’re sending. That’s a way lower margin, the challenge here however is that Palan express is very traditional and you might find it trickier to find an outlet to receive money from.

Tambunting Pera Padala Rates: Tambunting is one of the country’s leading pawnshops that have recently added a remmittance end to their services. Tambunting partners with big remittance centers such as Western Union and Transfast and acts as an additional venue for sending and receiving remittance in their behalf.

Cebuana Lhuillier: Another pawnshop-turned-remittance-center! Cebuana Lhuillier is one of the most popular names in the Philippines, with over 2,500 branches nationwide – this is probably the most present remittance center in the country with overseas remittance rates that range from ₱500 – ₱1,200 (around $10 to $20-ish).Aside from these local players, Filipino professionals also send and receive money through: Wise, Paypal, Remitly, Monito, Xoom, and the like.

Go digital

And while remittance in the Philippines is still mostly traditional, the market is seeing a big shift to digital remittance thanks to leading digital players.

Gcash: Gcash is a mobile wallet that lets you cash in, receive, send, pay on the spot for, invest, and save your money in a digital holding account. Gcash is the first of its kind in the Philippines and one that has shifted so many Filipinos digitally. It has also rolled out its remittance options to allow users to send and receive money from different parts of the world.

UB Online: Digital banking has also been paving the way for financial literacy and mobile remittance among Filipinos, and one of the leading banking apps is the UB online by the Unionbank of the Philippines.

TANG App: If you’re looking for a future-driven way of sending your money across borders, then the TANGApp is a great digital remittance option for you. It’s easy to use, convenient, and presents you with real-time fx rates and cheaper transaction fees. Focused on OFWs, TangApp’s vision is to make sending money abroad as easy as sending a text message – it’ll only take a few seconds!

There is definitely a lot more work to be done in terms of shifting the market digitally, but for the time the Philippines has spent into shifting consumers (3 years as of writing), the growth is not bad at all. The pandemic period worked wonders for the Philippines in terms of digital shift because that 2-year timeline pushed a 92% adoption rate for digital transactions.

Unfortunately, the Philippines is still struggling to get their footing in terms of financial inclusion. The good news is, the pandemic largely contributed to underserved Filipinos being able to finally open a financial account of sorts given Gcash and GrabPay’s digital accounts.. The bad news is – as of writing 44% of Filipinos are still financially excluded. So what can we do about it?

At Machnet, we help visionaries and founders bring their business’ purpose to life. By adding a remittanc or , B2B payment feature in your current set up, not only are you growing as a business but are touching lives as you go along. You’re contributing to lowering the financial exclusion. Take KonsultaMD for example. As the leading HealthTech player in the Philippines with over 2M in downloads, they can easily embed Machnet in their system – allowing every user to send and receive money from the US in just a few taps to pay for care bill.. Whether it’s for the user’s Filipino mom at home’s maintenance medicine, hospital bill, or even for their health insurance. Imagine how convenient that would be to have 1 App for everything health-related – and to be able to know that your loved ones back home are getting the treatment and medications they need even from thousands of miles away. Now that’s innovation!